Umbrella Insurance for High Net-Worth Individuals – Why You Need It in 2025

Umbrella Insurance for High Net-Worth Individuals

Umbrella Insurance for High Net-Worth Individuals – Why You Need It in 2025

As a high-net-worth individual, your life is likely filled with opportunities, luxury, and potential risks that most people don’t encounter. You’ve worked hard to build your wealth, so the last thing you want is for a lawsuit, accident, or unforeseen event to threaten your hard-earned assets. That’s where umbrella insurance comes into play.

In this comprehensive guide, we’ll walk through everything you need to know about umbrella insurance for high net-worth individuals, from understanding its core benefits to finding the best umbrella insurance for wealthy individuals. We’ll also delve into luxury home umbrella insurance, ensuring your multimillion-dollar properties are well-protected.

What is Umbrella Insurance?

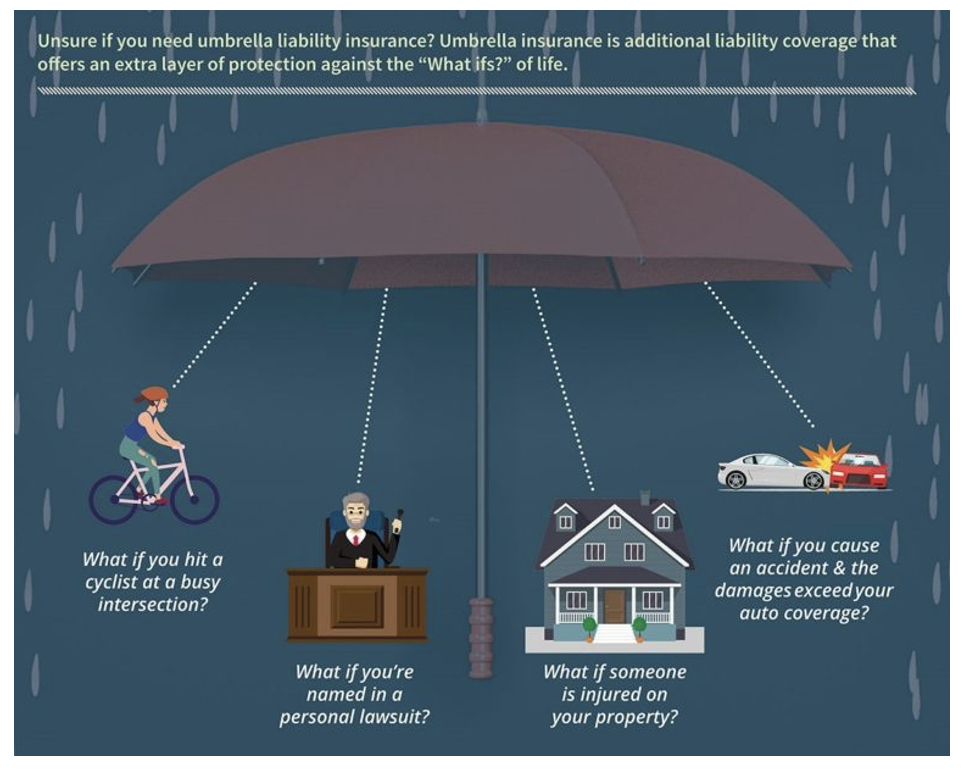

At its core, umbrella insurance is an additional layer of liability coverage that kicks in when your standard insurance policies, like auto or homeowners, are exhausted. Think of it as an extra cushion that ensures you don’t face financial ruin from a single lawsuit or accident.

Umbrella insurance for high net-worth individuals is tailored to provide even more extensive coverage due to the larger value of assets you may have. From yachts to luxury cars to expansive estates, you need more protection than the average person. Umbrella insurance helps protect your personal wealth by covering legal fees, settlements, and claims that may arise in various scenarios.

Read Also: How Much Life Insurance Do Seniors Really Need? 6 Tips for Determining Coverage

Why High Net-Worth Individuals Need Umbrella Insurance

With great wealth comes great responsibility—and greater exposure to risk. High-net-worth individuals face numerous liabilities that can put their wealth at risk. Whether it’s a car accident involving a luxury vehicle or a slip-and-fall accident at your estate, umbrella insurance for high net worth individuals provides additional coverage when other policies reach their limits.

Key Benefits of Umbrella Insurance for Wealthy Individuals

The benefits of umbrella insurance for wealthy individuals are immense. Here are the key reasons why you should consider this extra layer of protection:

- Extra Liability Protection: Once your auto or home insurance reaches its limits, umbrella insurance ensures you’re still covered. SourceForbes+1Forbes+1

- Lawsuits and Legal Fees: Legal expenses can quickly spiral out of control. Umbrella insurance helps pay for defense costs and any settlements. SourceAAA+3Allstate+3Risk Strategies+3

- Peace of Mind: You’ve built a substantial portfolio—why not protect it? Umbrella insurance gives you peace of mind knowing you’re covered against the unexpected. SourceXinsuranceBrighton Jones Wealth Management

Best Umbrella Insurance for Wealthy Individuals

When choosing the best umbrella insurance for wealthy individuals, it’s essential to look for policies that provide higher limits, customizable coverage, and extra protections for high-value assets. Look for insurers with a strong reputation for handling claims, offering global coverage (if applicable), and specializing in the unique needs of high-net-worth clients. SourceForbes+1Forbes+1

Luxury Home Umbrella Insurance

If you own a luxury home, traditional homeowners’ insurance may not provide enough protection. Luxury home umbrella insurance ensures that your mansion or estate is covered in case of accidents or liabilities that arise on your property. This coverage can also extend to valuable collections, personal property, and guest-related accidents. SourceXinsurance

How Does Umbrella Insurance Work?

Umbrella insurance doesn’t operate independently; it supplements existing coverage. If you’re involved in an accident or incident that causes damage or harm, your primary policies (auto, home, etc.) will cover the initial costs. However, when those limits are reached, umbrella insurance kicks in to cover the remaining costs. Think of it as the safety net beneath the tightrope you walk as a wealthy individual.

How Much Umbrella Insurance Do You Need?

Determining how much umbrella insurance you need isn’t a one-size-fits-all formula. Factors such as your net worth, assets, lifestyle, and the level of risk you face will determine your ideal coverage. As a general rule, most experts recommend coverage that’s 10 times your annual income or more. For someone with significant wealth, this could mean a policy limit of $10 million or higher. SourceRisk Strategies

Cost of Umbrella Insurance for High Net-Worth Individuals

While umbrella insurance for high net-worth individuals can seem expensive, it’s actually quite affordable when compared to the value it provides. Premiums typically range from $150 to $300 per year for the first $1 million of coverage, with additional coverage costing a bit more. It’s a small price to pay to protect your wealth.

Conclusion: Why Umbrella Insurance is a Must for High Net-Worth Individuals

In conclusion, umbrella insurance is essential for anyone with significant wealth. It acts as an extra layer of protection, ensuring that your assets are safe from the unexpected. Whether you own luxury homes, high-end cars, or expensive collections, umbrella insurance provides the peace of mind you need to continue living life on your terms.

FAQs

1. What exactly does umbrella insurance cover?

Umbrella insurance covers liabilities beyond your standard insurance policies, such as lawsuits, legal fees, and large settlements.

2. Is umbrella insurance necessary if I already have home and auto insurance?

Yes, umbrella insurance is necessary if your assets exceed the coverage limits of your primary policies.

3. How do I calculate how much umbrella insurance I need?

You can calculate your needs based on your total net worth, assets, and potential risks. Generally, it’s recommended to have coverage that is 10 times your annual income.

4. Can I bundle umbrella insurance with my existing policies?

Yes, many insurance providers offer bundle options that combine umbrella insurance with home, auto, or other policies for a reduced cost.

5. What happens if I don’t have enough umbrella insurance to cover a lawsuit?

If your umbrella insurance doesn’t cover the entire claim, you would be personally liable for the remaining balance. That’s why it’s crucial to ensure adequate coverage.

Call to Action:

Did you find this guide helpful? Share your thoughts in the comments below or reach out if you have any questions about umbrella insurance for high net-worth individuals. Protect your wealth today—ensure you’re covered for whatever life throws your way!

One Comment