How Much Life Insurance Do Seniors Really Need? 6 Tips for Determining Coverage

How Much Life Insurance Do Seniors Really Need? 6 Tips for Determining Coverage

When it comes to life insurance for seniors, the amount of coverage you need can vary significantly based on your personal circumstances, goals, and financial situation. The reality is that seniors often face unique considerations when selecting life insurance policies—whether it’s to cover final expenses, pay off existing debts, or leave a legacy. The key is to determine how much coverage is sufficient to meet these needs without over-insuring.

In this comprehensive guide, we’ll explore how much life insurance seniors really need, along with 6 tips for determining the right amount of coverage. By the end, you’ll be equipped to make an informed decision about the best life insurance for seniors over 60 and whether term life insurance for seniors is the right choice for you.

Understanding Life Insurance for Seniors

Life insurance for seniors serves as a financial tool designed to provide your loved ones with financial security after your passing. Seniors, however, have different needs than younger individuals. Your life insurance may be used to cover final expenses, pay off outstanding debts, or provide a financial cushion for your family.

There are various types of life insurance policies tailored specifically to seniors, each offering different benefits, costs, and coverage amounts. These policies include term life insurance, whole life insurance, final expense insurance, and more.

The Importance of Determining the Right Coverage

Why does the right amount of coverage matter? Overestimating or underestimating how much life insurance you need can have serious consequences. Paying for unnecessary coverage can be a financial burden, while insufficient coverage may leave your loved ones with unpaid debts or funeral expenses.

To avoid these risks, you need to carefully assess your financial situation, your family’s needs, and the specific expenses you want your life insurance to cover.

6 Tips for Determining How Much Life Insurance Seniors Really Need

Tip #1: Calculate Your Final Expenses

One of the primary reasons for obtaining life insurance is to cover end-of-life costs. These expenses can be substantial, encompassing funeral services, medical bills, and other related costs.

-

Funeral Costs: The median cost of a funeral with a casket burial is approximately $8,300, while cremation averages around $6,280. Investopedia

-

Medical Bills: Any outstanding medical expenses incurred during end-of-life care should be considered.

-

Estate Settlement Costs: Legal fees and other costs associated with settling an estate can add up quickly.

For many seniors, final expense insurance is a suitable option, specifically designed to cover these costs. These policies typically offer smaller death benefits with lower premiums. Aflac

Tip #2: Consider Your Dependents

If you have a spouse, children, or other dependents who rely on your income, it’s crucial to account for their financial needs in your coverage.

-

Income Replacement: Ensure that your policy provides enough to replace lost income, covering daily living expenses, mortgage payments, and other financial obligations.

-

Education Expenses: If you have dependent children, consider future educational costs that your policy could help cover.

Even in retirement, some seniors continue to support adult children or other family members, making it essential to factor these ongoing financial commitments into your coverage needs.

Tip #3: Pay Off Debts and Financial Obligations

Life insurance can play a pivotal role in settling any remaining debts, preventing your loved ones from inheriting financial burdens.

-

Mortgage: Ensure that your policy can cover the remaining balance of your mortgage.

-

Personal Loans and Credit Cards: Include any other debts that might need to be paid off after your passing.

According to Investopedia, if you retire with debt or still earn income for your family, maintaining life insurance in retirement is advisable. Investopedia

Tip #4: Factor in Future Medical Expenses

Healthcare costs often rise with age, and it’s wise to anticipate these potential expenses.

-

Long-Term Care: Consider whether you might need assistance with daily activities in the future and how to fund this care.

-

Medical Emergencies: Ensure that your policy can help cover unexpected medical costs not fully paid by Medicare or other health insurance.

Some life insurance policies offer riders that provide benefits for chronic or terminal illnesses, which can be beneficial in managing long-term care costs. Investopedia

Tip #5: Review Your Current Savings and Assets

Your current financial resources can influence the amount of life insurance you need.

-

Retirement Accounts: Assess the sufficiency of your retirement savings to support your spouse or dependents.

-

Investments and Savings: Consider how your other assets can be utilized to cover expenses.

Having substantial savings might reduce the necessity for a large life insurance policy. However, it’s essential to ensure that these assets are allocated appropriately to cover all potential expenses without depleting your estate.

Tip #6: Consider Your Legacy and Charity Contributions

If leaving a financial legacy or making charitable contributions is important to you, factor these desires into your coverage amount.

-

Inheritance: Determine how much you’d like to leave to heirs, ensuring that your policy aligns with this goal.

-

Charitable Contributions: If supporting charitable causes is a priority, consider how your life insurance can facilitate this.

Strategically, some families are using life insurance to cover potential inheritance tax liabilities, preserving wealth for future generations. Latest news & breaking headlines

Types of Life Insurance for Seniors

Term Life Insurance for Seniors

Term life insurance is one of the most popular types of coverage for seniors. It provides protection for a specified period, such as 10, 20, or 30 years. If you pass away during the term, your beneficiaries receive a death benefit.

- Pros: Affordable premiums, flexible term lengths.

- Cons: Coverage expires at the end of the term, no cash value.

For those who need coverage for a limited time, term life insurance for seniors can be an excellent choice.

Choosing the Right Type of Life Insurance

Selecting the appropriate life insurance policy is crucial. For seniors, term life insurance is often recommended due to its affordability and simplicity. It provides coverage for a specified period, such as 10, 20, or 30 years, and is generally more cost-effective than permanent life insurance. Fidelity Life

However, if you seek lifelong coverage and the potential to accumulate cash value, whole life insurance might be more suitable. It’s essential to assess your financial situation, health status, and coverage needs when making this decision.

Whole Life Insurance for Seniors

Whole life insurance offers lifelong coverage and builds cash value over time. It’s ideal for seniors who want permanent coverage and the added benefit of a cash value component.

- Pros: Lifetime coverage, cash value accumulation.

- Cons: Higher premiums compared to term life insurance.

Conclusion

Determining how much life insurance seniors really need requires a thoughtful approach. By considering your financial obligations, dependents, and personal goals, you can select the right amount of coverage to protect your loved ones without overpaying. Whether it’s term life insurance for seniors, whole life insurance, or final expense insurance, the key is to choose a policy that meets your specific needs.

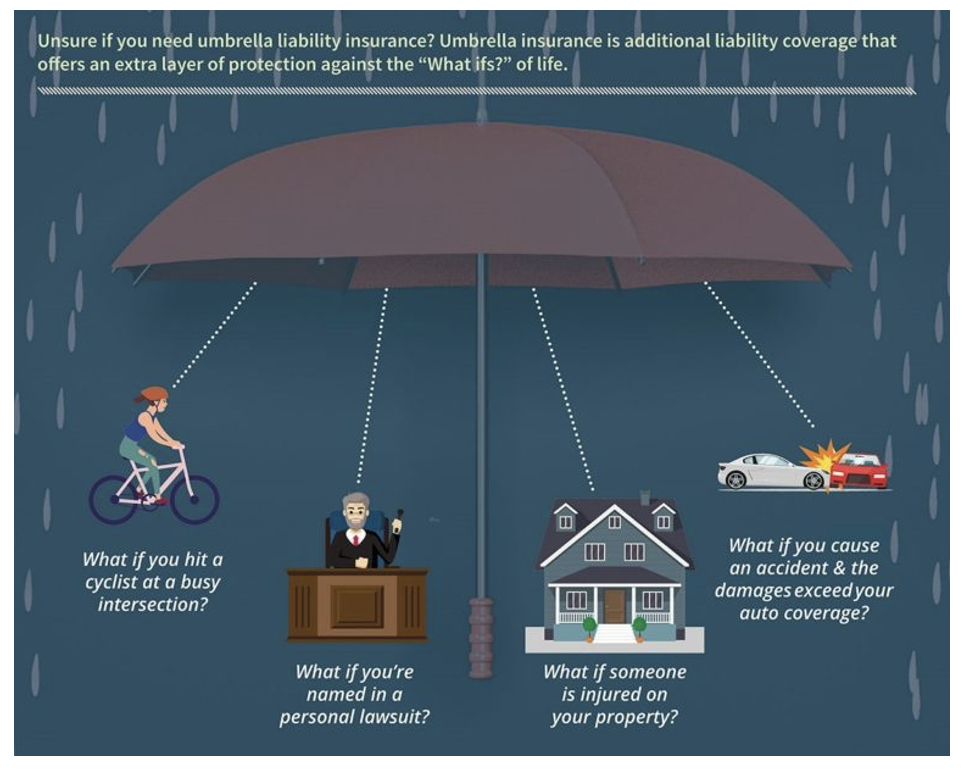

Read Also: Umbrella Insurance for High Net-Worth Individuals – Why You Need It in 2025

FAQs

- How do I calculate how much life insurance I need as a senior?

Consider final expenses, outstanding debts, dependents, and any future medical costs when calculating your needs. - What is the difference between term life insurance and whole life insurance for seniors?

Term life is temporary and affordable, while whole life offers permanent coverage and builds cash value. - Can I get life insurance if I have health problems?

Yes, seniors with health issues can still obtain life insurance, but premiums may be higher. Options like guaranteed issue life insurance are available for those with severe health problems. - Is final expense insurance enough for seniors?

Final expense insurance can cover funeral and end-of-life costs, but if you have larger financial obligations, you may need a larger policy. - How can I lower the premiums on life insurance as a senior?

Consider term life insurance for lower premiums, or shop around for competitive quotes to get the best rate.

Call to Action:

What type of life insurance do you need as a senior? Let us know in the comments below or reach out for personalized advice! Don’t forget to compare quotes and find the best plan for your future!

One Comment